Setup Beyond Used Parts Tax

This chapter describes how to set up Beyond Used Parts Tax. Note that certain user permissions (SUPER or BYD UP ADMIN) are required to set up Beyond Used Parts Tax. To set up Beyond Used Parts Tax, proceed as follows:

- Open the search function from the role center (ALT+Q).

- Search for General Ledger Setup and click on the appropriate search result.

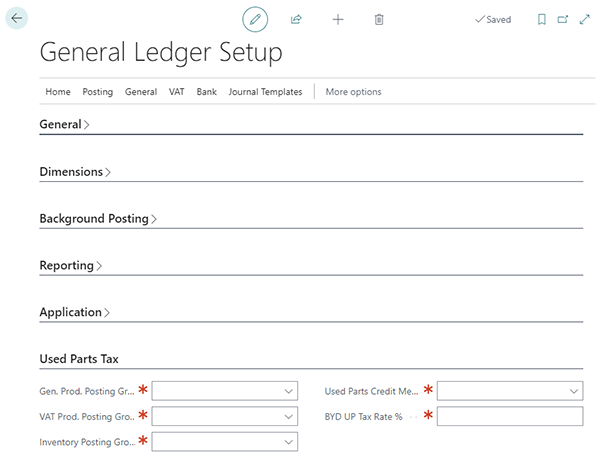

- The General Ledger Setup page is displayed.

- Mandatory fields are displayed under the Used Parts Tax tab.

- Enter the required information in the fields:

- Gen. Prod. Posting Group: Specify the general product posting group in this field.

- VAT Prod. Posting Group: In this field, specify the VAT product posting group. When specifying the VAT product posting group, note that you specify a VAT Business Posting Group during setup, as well as the mandatory information for the Sales VAT Account and Purchase VAT Account fields.

- Inventory Posting Group: Specify the inventory posting group in this field.

- Used Parts Credit Memo: In this field, specify the resource to be used for the used parts tax. We recommend that you create a new resource called Used Parts Tax. When creating the resource, make sure that you maintain the information under the Invoicing tab in the General Prod. Posting Group and VAT Prod. Posting Group fields on the resource card.

- BYD UP Tax Rate %: In this field, specify the percentage assessment basis from the new part.

You have set up Beyond Used Parts Tax.